- Federal taxes for small business midlothian va how to#

- Federal taxes for small business midlothian va code#

- Federal taxes for small business midlothian va free#

If dealing with payroll leaves you stressed out and overwhelmed we can help. Payment of third-party withholdings such as insurance User-friendly, and easy to understand monthly, quarterly, and annual payroll tax reports Payroll reporting by employee or department Payroll tax compliance, e-filing, tax payments We also stay on top of legislation affecting payroll compliance, so you don’t need to.ĭirect Deposit and Electronic Fund Transfer (EFT) There’s no need for you to hire an in-house specialist or maintain a payroll system. When you outsource your payroll responsibilities to us you get a dedicated payroll specialist who works with you throughout the entire payroll process. Outsourcing Your Payroll Is More Affordable Than You Think. You might be able to handle payroll on your own, but wouldn’t your time be better spent on developing new products or services for your business? If you’re just starting out, you may only have a few employees to worry about.

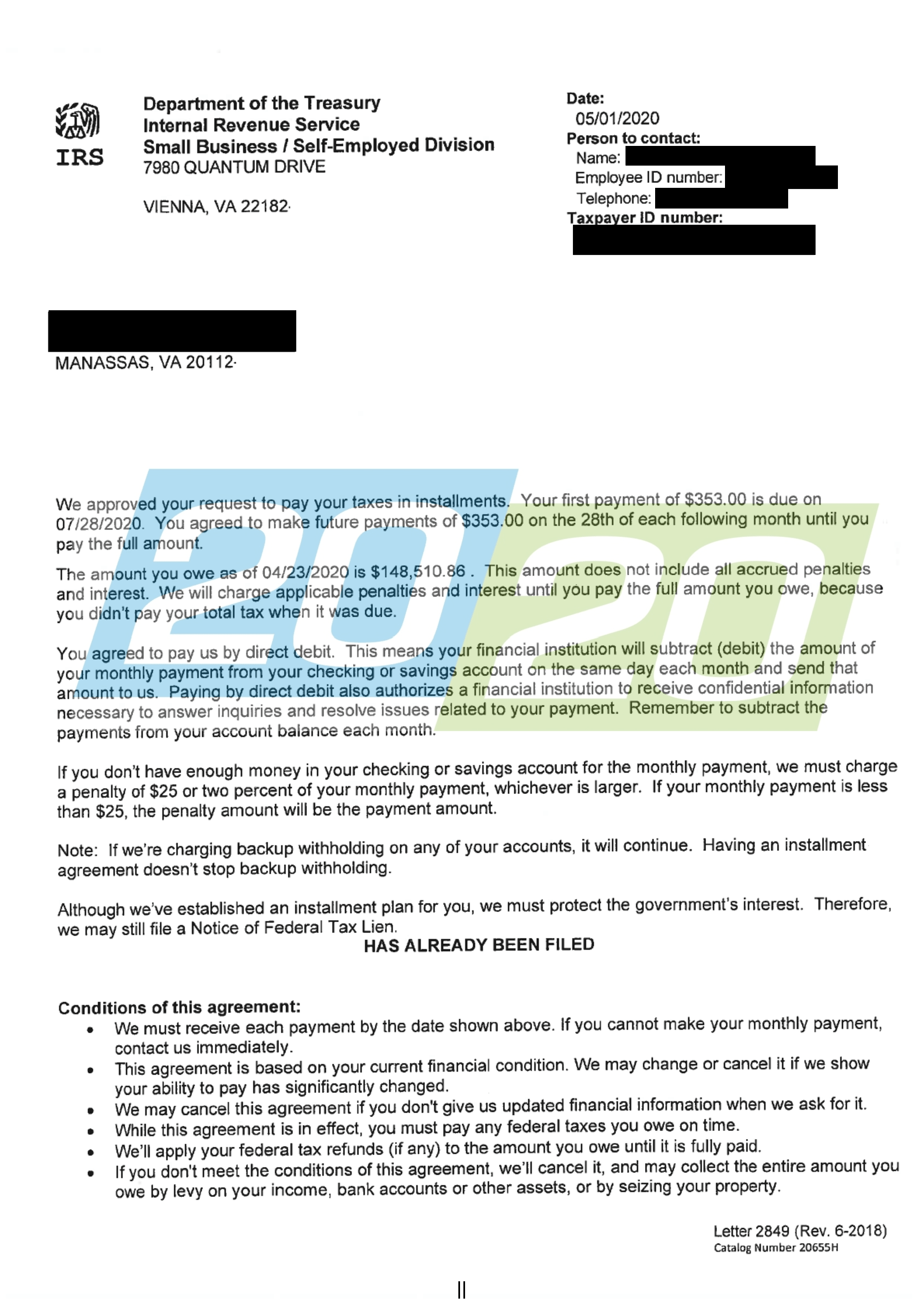

It seems like every year a new piece of federal, state, or local legislation related to payroll is passed that you need to comply with. If you own a small to medium-sized business with more than a few employees, you already know that payroll is complicated. While it may not seem like a lot of time, it does add up-and it takes time away from running your business. On average, small business owners spend eight hours per month on payroll-related tasks. We understand tax planning for non-profits and will make sure your records meet government standards.Cost-Effective Payroll Services for Your Business Non-profit organizations are under constant scrutiny from the IRS and must stay in compliance in order to maintain their tax exempt status. We'll find ways to minimize taxes while making sure your business is in compliance with Federal and State tax regulations. We're experienced tax accountants can deal with tax laws across multiple states. We offer alternative minimum tax planning to deal effectively with this tax and can prepare the necessary paperwork to determine if you owe Alternative Minimum Tax. Our goal is to manage your effective tax rate so more profits are directed towards your bottom line. Strategic Tax PlanningĪs your trusted tax advisor, we carefully anticipate how your business could be impacted by tax laws.

Federal taxes for small business midlothian va free#

Call us at 80 and request a free initial consultation to learn more. Conscientious tax planning throughout the year can save you money and make tax time easier. Comprehensive Tax Planning and Tax Return Compilation Services. Our Customized Business/Corporate Services Include.

We offer services customized to fit the needs of your company, and can fit into nearly any budget.

Federal taxes for small business midlothian va code#

We offer a variety of tax planning services to both businesses and individuals. Our continual research of current Federal Tax Court cases and Tax Code updates allows us to keep you informed of the most up to date strategies.

Tax Planning for Businesses and Individuals We also provide income tax planning for individual business owners and taxpayers and will find ways to reduce your income taxes so you can keep more of what you earn. Federal excise tax rates on beer, wine, and liquor are as follows: Beer : 18.00 per 31-gallon barrel, or 0.05 per 12-oz can : Wine : 1.07 - 3.40 per gallon, or 0.21 - 0.67 per 750ml bottle, depending on alcohol content : Distilled Spirits : 13.50 per proof-gallon, or 2.14 per 750ml 80-proof bottle A proof gallon is a gallon of. If you're starting a new business, we can determine which business structure will bring the highest tax savings now and down the road. Some tax discounts are available to small brewers. The maze of tax laws change regularly so we're constantly educating ourselves on any revisions that could affect our small business clients then we take proactive measures to develop strategies that will minimize the impact to your profits.

Federal taxes for small business midlothian va how to#

We're proficient in tax regulations and know how to coordinate tax planning techniques that will reduce tax liabilities. When you turn to us for guidance, we'll draw on our wealth of tax planning experience and offer advice on what choices make the most financial sense. Before making any costly mistakes, consult with a reliable Richmond, VA accounting firm like Anchor Accounting Services. Business decisions can result in unanticipated tax consequences.

0 kommentar(er)

0 kommentar(er)